FOR IMMEDIATE RELEASE

March 22, 2022

MARTA,

GOLDMAN SACHS ANNOUNCE $100 MILLION INCREASE TO ATLANTA AFFORDABLE HOUSING AND

TRANSIT-ORIENTED DEVELOPMENT INITIATIVE

Initiative

Closes First Transaction, Breaks Ground on Skyline Apartments at Future

Terminus of Summerhill BRT in South Atlanta

ATLANTA – The Metropolitan Atlanta Rapid Transit Authority (MARTA) today announced a $100 million increase in its initiative with the Goldman Sachs Urban Investment Group within Goldman Sachs Asset Management (Goldman Sachs), which seeks to identify opportunities to finance new development in close proximity to MARTA.

This $100 million increase will bring the overall initiative target up to $200 million. The Atlanta Affordable Housing and Transit-Oriented Development (TOD) Initiative is a flexible, multi-product program designed to promote and support the development of ground-up mixed-income, TOD projects that benefit from

proximity to MARTA’s 38 heavy rail stations, 12 Atlanta Streetcar light rail stops and in new transit investment corridors. The Initiative will continue to focus on projects financed through Goldman Sachs’ One Million Black Womeninitiative, a $10 billion commitment to advance racial equity by investing in

Black women.

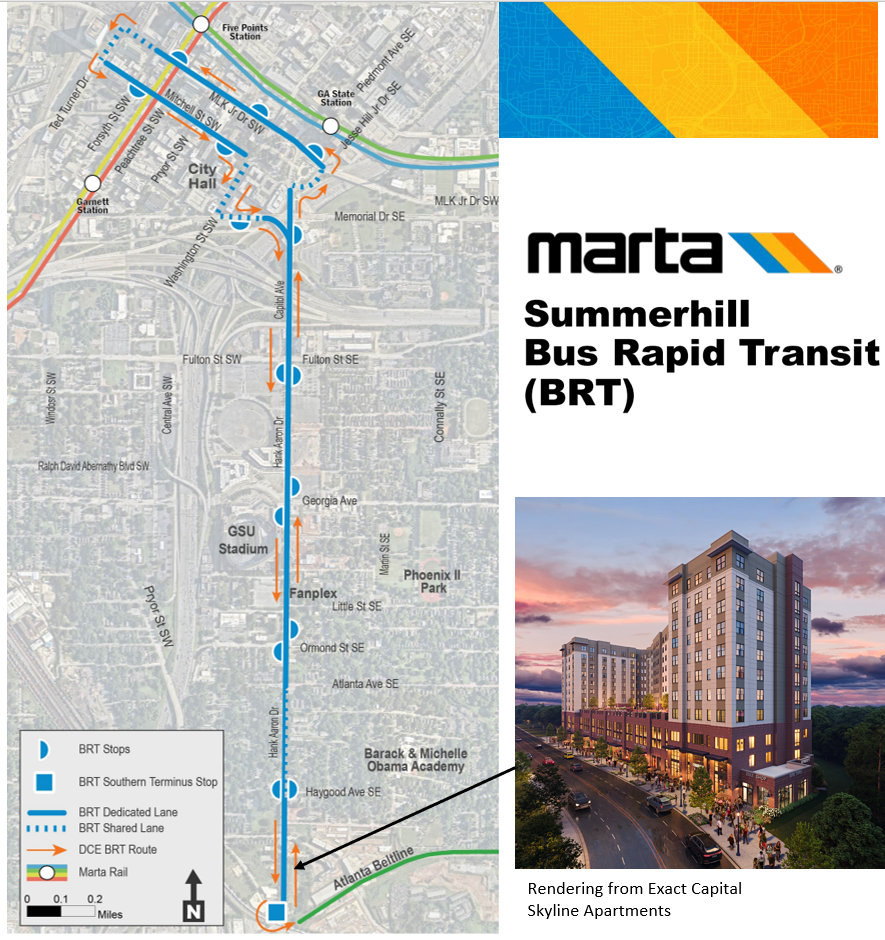

A groundbreaking was held today at 1090 Hank Aaron Drive in Atlanta to mark the beginning of the development of Skyline Apartments, a 250-unit affordable housing community, and the first investment made as part of the original $100 million initiative in partnership with Goldman Sachs. Skyline is across the

street from the southern terminus of MARTA’s planned Summerhill Bus Rapid Transit (BRT) project which will connect the Southeast BeltLine to heavy rail stations and bus routes in South Downtown Atlanta, both areas experiencing significant investment and redevelopment. The area between these two nodes is

also experiencing rapid growth so the timing of the transit connectivity is ideal as density increases in this corridor. The rapid transit service is expected to be operational by the end of 2024.

“We thank Goldman Sachs for helping to increase affordable housing density at and around our existing and planned transit infrastructure with this first transaction on Hank Aaron Drive,” said MARTA Interim General Manager and CEO Collie Greenwood. “And this $100 million increase in our initiative with

Goldman Sachs supports our ongoing mission to provide an equitable and holistic approach to serving the communities in which we operate with transit and community development.”

“The Urban Investment Group is proud to reaffirm its engagement in Atlanta by doubling the targeted size of our affordable housing and TOD initiative with MARTA,” said Yarojin Robinson, Managing Director in the Urban Investment Group within Goldman Sachs Asset Management. “By investing in affordable housing near

MARTA’s transit offerings, the Initiative will help to ensure that Atlanta remains accessible for all residents, regardless of household income. In addition, through projects like Skyline Apartments that are aligned with the firm’s One Million Black Women initiative, we are committed to

partnering with Black-owned and -led developers and investing in majority-minority communities.”

Through the Initiative, Goldman Sachs will seek to provide capital via Low-Income Housing Tax Credit (LIHTC) equity, joint venture equity, and traditional construction debt, benefitting developers of affordable and mixed income housing projects and stimulating growth and opportunity across Atlanta. MARTA

continues to support its jurisdictional partners in meeting their affordable housing goals through its transit-oriented development program and innovative financing partnerships.

About the Goldman Sachs Asset Management Urban Investment Group (UIG)

Bringing together traditional and alternative investments, Goldman Sachs Asset Management provides clients around the world with a dedicated partnership and focus on long-term performance. As the primary investing area within Goldman Sachs (NYSE: GS), we

deliver investment and advisory services for the world’s leading institutions, financial advisors and individuals, drawing from our deeply connected global network and tailored expert insights, across every region and market—overseeing more than $2 trillion in assets under supervision worldwide as of December 31,

2021. Driven by a passion for our clients’ performance, we seek to build long-term relationships based on conviction, sustainable outcomes, and shared success over time. Goldman Sachs Asset Management invests in the full spectrum of alternatives, including private equity, growth equity, private credit, real

estate and infrastructure. Established in 2001, the Urban Investment Group within Goldman Sachs Asset Management has committed over $10 billion through real estate projects, social enterprises and lending facilities for small businesses and students, creating economic value and opportunities for

underserved communities and families. Follow us on

LinkedIn.

About One

Million Black Women

In partnership with Black-women-led organizations, financial institutions and other partners, Goldman Sachs has committed $10 billion in direct investment capital and $100 million in philanthropic capital over the next decade to address the dual disproportionate gender and racial biases that Black women have faced for

generations, which have only been exacerbated by the pandemic. The initiative, One Million Black Women, is named for and guided by the goal of impacting the lives of at least one million Black women by 2030. Goldman Sachs research has shown that sustained investments in Black women across the core pillars of

housing, healthcare, access to capital, education, job creation and workforce advancement, digital connectivity and financial health will catalyze economic growth, making for not only a fairer, but also a richer society.

###